Introduction:

Shopify has emerged as a leading e-commerce platform, offering a wide range of services to businesses of all sizes. The company’s user-friendly interface and advanced features have made it a popular choice among entrepreneurs looking to establish an online presence. This article provides an in-depth analysis of Shopify’s financial performance, growth drivers, and challenges, along with an overview of its future outlook as an investment option.

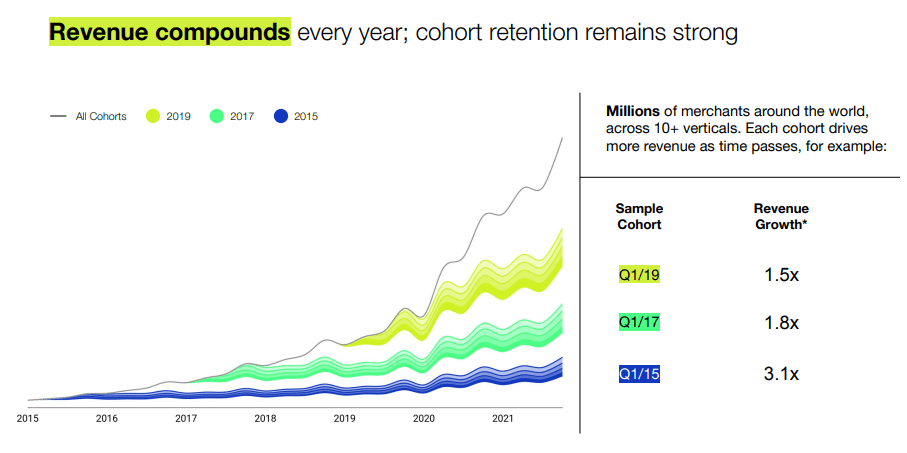

Shopify’s Financial Performance: Shopify’s financial performance has been remarkable, with significant growth in recent years. In 2020, the company’s revenue reached $2.93 billion, up by 86% compared to the previous year. Its gross merchandise volume (GMV) also surged by 96% YoY, indicating a high demand for its services. Shopify’s net income has been positive since 2016, and it has consistently generated positive cash flow from operations. The company’s financial statements indicate a robust business model that has enabled it to sustain its growth trajectory.

Shopify’s Growth Drivers:

Several factors are driving Shopify’s growth, making it a compelling investment option. Firstly, the company’s scalable platform can accommodate businesses of all sizes, making it an attractive option for startups and small businesses. Secondly, the global e-commerce market is expanding rapidly, and Shopify is well-positioned to benefit from this trend. The company is continually improving its platform’s features to enhance user experience and stay ahead of the competition.

Moreover, Shopify is expanding beyond e-commerce, offering services such as Shop Pay Installments, which enables buyers to pay in installments, potentially increasing sales for merchants. The company is also investing heavily in augmented reality (AR) and virtual reality (VR) technologies, which could revolutionize the online shopping experience. These initiatives are critical in maintaining Shopify’s competitive edge and driving its growth.

Challenges Facing Shopify:

Despite its impressive growth, Shopify faces several challenges that could impact its future prospects. One significant challenge is competition. E-commerce giants such as Amazon, Walmart, and eBay are significant competitors that could pose a threat to Shopify’s market position. These companies have substantial financial resources that they can use to enhance their platforms, making it challenging for Shopify to compete.

Another challenge facing Shopify is its dependence on third-party apps and integrations. While these apps are essential to the Shopify ecosystem, the company relies on third-party developers to create and maintain them. Any issues with these apps or integrations could affect the user experience, leading to a decline in usage and potential reputational damage.

Outlook for Shopify Stock:

Overall, Shopify’s future outlook as an investment option is positive. The company’s robust financial performance and growth prospects make it an attractive investment option. However, potential investors must be aware of the risks and challenges facing the company, such as stiff competition and dependence on third-party apps. The company’s investments in AR/VR technologies and new services like Shop Pay Installments are likely to drive its growth in the future.

Moreover, the COVID-19 pandemic has accelerated the shift to e-commerce, providing Shopify with a unique opportunity to expand its market share. The company’s focus on innovation, scalability, and a user-friendly platform gives it a competitive advantage that is likely to continue driving its growth.

Conclusion:

In conclusion, Shopify is a robust and scalable e-commerce platform that has delivered impressive financial results in recent years. Its growth prospects are bright, driven by the expansion of the e-commerce market and the company’s investments in new technologies and services. However, potential investors must be aware of the risks and challenges facing the company, including stiff competition and dependence on third-party apps.